The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman, brings major tax reforms, infrastructure investments, and relief measures for the middle class. With no tax on income up to Rs 12 lakh, increased standard deductions, and sector-wise allocations, this budget aims to drive economic growth while maintaining fiscal discipline.

Key highlights include changes in income tax slabs, updates in the direct tax code 2025, and increased funding for railways, smart infrastructure, and AI-driven mining.

Whether you’re a taxpayer, investor, or business owner, these reforms will impact you. Read on for a complete breakdown of the Finance Budget 2025 and its implications for the economy and daily life.

Budget 2025 Key Highlights

1. Income Tax Relief:

FM Sitaraman announces a complete tax rebate for individuals with annual incomes up to ₹12 lakh, Now those people who have an income <= 12 lacks will pay 0 tax. Which will significantly benefit the middle class.

2. TDS and TCS Adjustments:

Raised threshold for TDS on interest income for senior citizens from ₹50,000 to ₹1 lakh and increased TDS on rent limit from ₹2.4 lakh to ₹6 lakh.

3. Agriculture Boost:

The government will launch a Six-year program to increase pulses and cotton production, reducing import dependency. The agriculture budget for the financial year 2025-26 has been increased by 10%.

4. Manufacturing Incentives:

: ₹25,000 crore PLI scheme for electronic components to attract ₹40,000-₹45,000 crore in investments.

The Union government announced in budget FY25 a scheme to make India a global hub for toys by focusing on cluster development

5. Nuclear Energy Mission:

The Government Plan to achieve 100 GW of nuclear power by 2047 for sustainable energy growth.

6. Gig Economy Support:

The Indian Government launched an Initiatives to formalize gig workers, ensuring better healthcare and welfare benefits in 2025 budget.

7. Support for Startups and MSMEs:

The Government allocated 10000 crore in budget funds to foster entrepreneurship and business expansion.

Which product gets cheaper & Which products gets Costlier In Budget 2025

Items Becoming Cheaper in budget FY25:

- Life-saving Medicines: 36 cancer and rare disease medicines, and 37 other drugs exempt from customs duties.

- Mobile Phones and Chargers: Reduced basic customs duty from 20% to 15%.

- Gold and Silver: Customs duties reduced from 10% to 6%.

- Platinum: Reduced duties from 10% to 6.5%.

- Cancer Treatment Drugs: Three additional cancer treatment drugs exempt from duties.

- Seafood: Basic customs duty reduced from 10% to 5%.

- Solar Energy Components: No extension of customs duties on specific solar parts.

- Footwear: Reduction in customs duties on leather and footwear manufacturing.

- Ferro Nickel and Blister Copper: Removal of basic customs duties.

- Critical Minerals: Exemption from customs duties for 25 critical minerals.

- Shrimps and Fish Feed: Reduced customs duty to 5%.

- Electric Vehicle Batteries: Exemptions for battery manufacturing components.

- Shipbuilding: Reduced customs duties for 10 years on ships and parts.

Items Becoming Costlier in budget FY2025:

- Ammonium Nitrate: Customs duties increased from 5% to 10%.

- Non-Biodegradable Plastics: Customs duties raised from 20% to 25%.

- Telecom Equipment: Customs duties increased from 10% to 15%.

- Tax Collection at Source (TCS): 1% TCS applied on goods exceeding ₹10 lakh.

- Flat Panel Displays: Increased customs duties.

- Certain Electronic Parts: Raised duties on specific components like flat panel displays.

- Solar Glass: No extension of customs duty exemption, possibly increasing costs

Union Budget 2025 Income Tax Slab & New Tax Regime

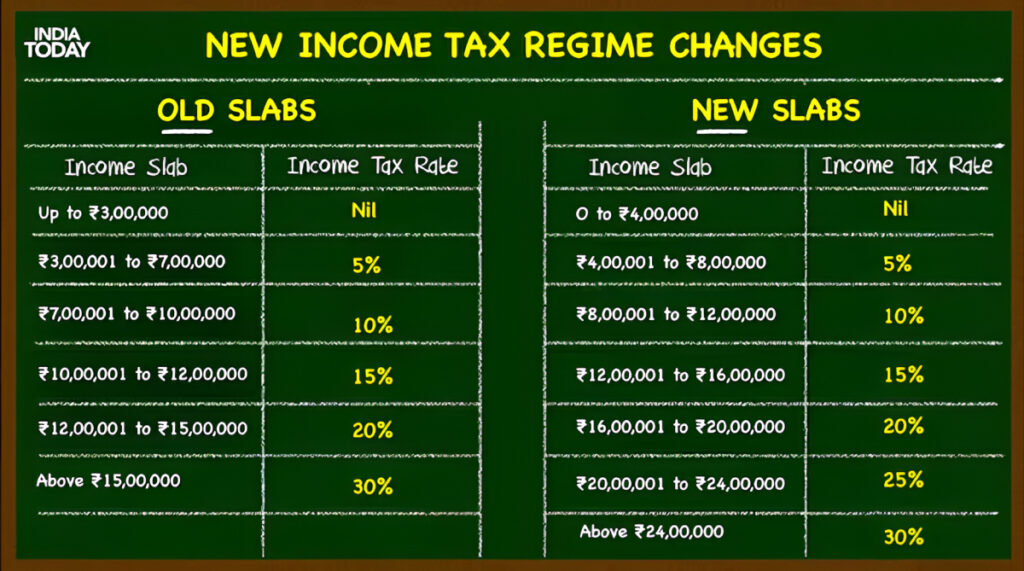

The Union Budget 2025 income tax slab introduces significant tax reforms aimed at benefiting the middle class and salaried employees.

- Revised Income Tax Slabs: Individuals earning up to ₹12 lakh annually are now exempt from income tax, an increase from the previous ₹7 lakh threshold, boosting disposable income.

- Standard Deduction Increase: Salaried employees and pensioners now enjoy an increased standard deduction from ₹50,000 to ₹75,000, helping counter rising living costs.

- Section 80C Deduction: The tax-saving investment limit under Section 80C has been raised from ₹1.5 lakh to ₹3.5 lakh, encouraging investments in PPF, life insurance, and ELSS.

Old vs New Tax Regime: Union Budget 2025 Income Tax slab

Source: India Today

Stock Market Performance Post-Budget

Following the budget 2025 announcement, the stock market exhibited mixed reactions. The Nifty 50 index declined by 0.11%, while the BSE Sensex saw a marginal increase of 0.01%. This subdued response reflects investor caution amid the proposed tax changes and their potential implications for market dynamics.

Summery of Budget 2025

The 2025 budget highlights several crucial changes impacting individuals and businesses across various sectors. From revised tax slabs to sector-wise financial allocations, this year’s budget focuses on long-term economic stability and growth. The Finance Budget 2025 reaffirms India’s commitment to progress, balancing development with fiscal responsibility.

With strategic tax reforms and major investments in infrastructure, Budget 2025 sets the stage for a more financially secure and growth-driven future. Stay tuned for Union Budget 2025 live updates to track how these changes unfold in the coming months.